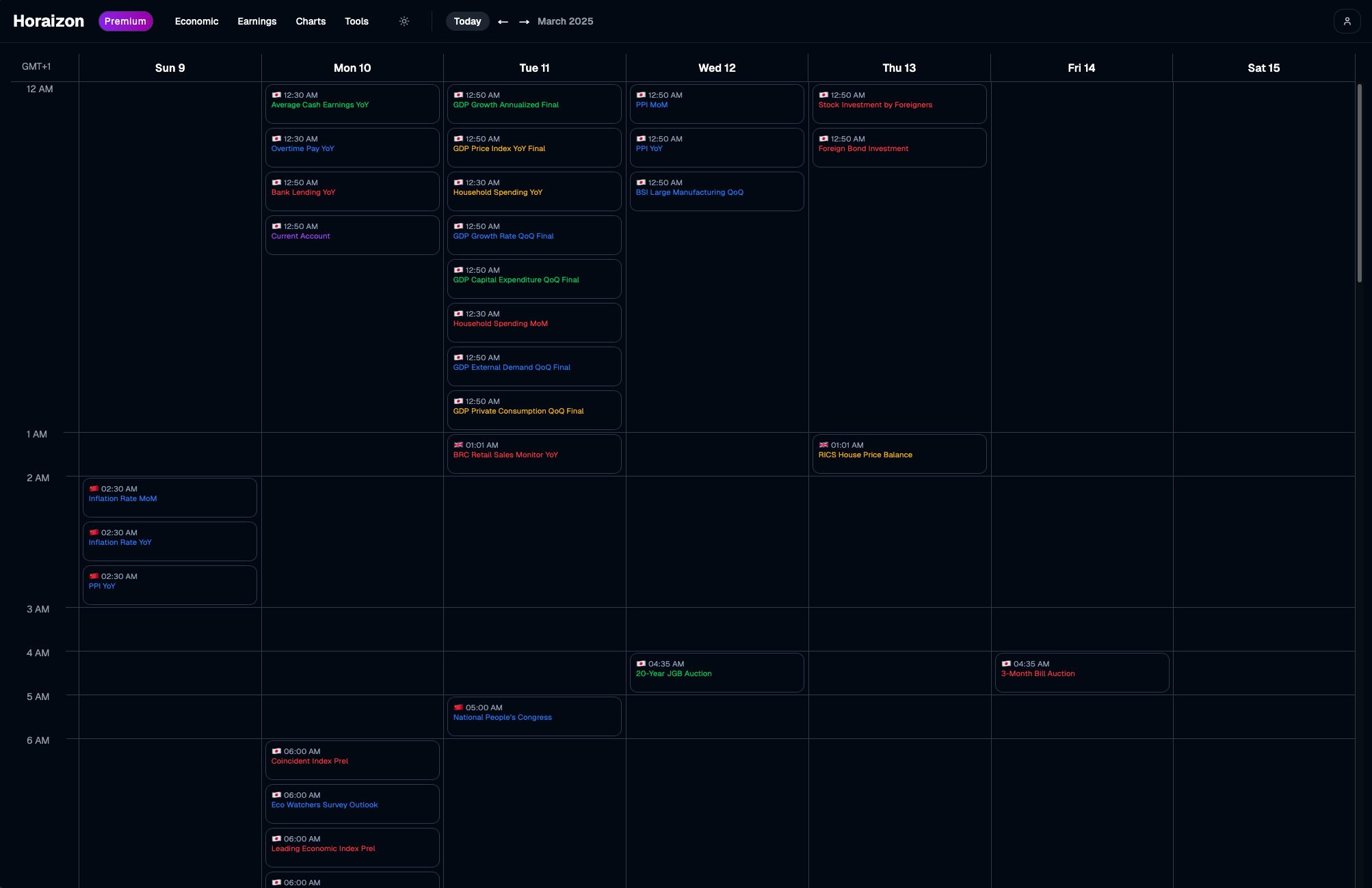

The AI-Powered Economic Calendar

for Smarter Trading

Track events, analyze their impact, and make data-driven decisions with the most accurate AI-powered event calendar.

We analyse real-time economic data and present you that in the correct time

Track events, analyze their impact, and make data-driven decisions with the most accurate AI-powered event calendar.AI Event Scoring

See which events actually move the market — and how much they matter, based on real historical behavior and asset sensitivity.

Personalized Event Feed

Cut through the noise with a feed tailored to your portfolio, showing only the events that could directly impact your trades.

Real-Time Alerts

Get instant notifications for high-impact events, so you're never caught off guard by unexpected volatility.

Stream Live Economic Events

Get instant notifications for high-impact events, so you're never caught off guard by unexpected volatility.

Forecast vs Actual Charts

Compare market expectations with real outcomes using clean, TradingView-powered charts built right into the platform.

Contextual Event Charts

Replay past events and visualize how similar situations moved the markets, giving you real context for every decision.

Trade Smarter with AI-Driven Economic Data

Horaizon helps traders unlock the full potential of economic insights, turning real-time data into smarter, data-driven trading decisions.Historical Event Replay

Review past events using TradingView-powered charts to analyze market reactions and refine your strategy.

Forecast vs. Actual Data Analysis

Forecast vs. Actual Data Analysis

Live Economic Event Streaming

Watch major economic announcements live, directly on the platform—no need to search elsewhere.

Impacted Assets Breakdown

Quickly identify which assets are affected by key economic events, so you can adjust your strategy with precision.

Smart Event Alerts

Set custom notifications based on country, category, or asset class—so you’re always ahead of the news that matters.

Tailored Calendar Views

Filter and personalize your event calendar to focus on only the data relevant to your trading style.

Historical Event Replay

Review past events using TradingView-powered charts to analyze market reactions and refine your strategy.

Forecast vs. Actual Data Analysis

Forecast vs. Actual Data Analysis

Live Economic Event Streaming

Watch major economic announcements live, directly on the platform—no need to search elsewhere.

Impacted Assets Breakdown

Quickly identify which assets are affected by key economic events, so you can adjust your strategy with precision.

Smart Event Alerts

Set custom notifications based on country, category, or asset class—so you’re always ahead of the news that matters.

Tailored Calendar Views

Filter and personalize your event calendar to focus on only the data relevant to your trading style.

Historical Event Replay

Review past events using TradingView-powered charts to analyze market reactions and refine your strategy.

Forecast vs. Actual Data Analysis

Forecast vs. Actual Data Analysis

Live Economic Event Streaming

Watch major economic announcements live, directly on the platform—no need to search elsewhere.

Impacted Assets Breakdown

Quickly identify which assets are affected by key economic events, so you can adjust your strategy with precision.

Smart Event Alerts

Set custom notifications based on country, category, or asset class—so you’re always ahead of the news that matters.

Tailored Calendar Views

Filter and personalize your event calendar to focus on only the data relevant to your trading style.

Historical Event Replay

Review past events using TradingView-powered charts to analyze market reactions and refine your strategy.

Forecast vs. Actual Data Analysis

Forecast vs. Actual Data Analysis

Live Economic Event Streaming

Watch major economic announcements live, directly on the platform—no need to search elsewhere.

Impacted Assets Breakdown

Quickly identify which assets are affected by key economic events, so you can adjust your strategy with precision.

Smart Event Alerts

Set custom notifications based on country, category, or asset class—so you’re always ahead of the news that matters.

Tailored Calendar Views

Filter and personalize your event calendar to focus on only the data relevant to your trading style.

Join Thousands of Traders Using AI-Powered Insights

notanothertrader

notanothertrader vixhunter93

vixhunter93 l33tdreams

l33tdreams chartpotato

chartpotato slapthebid

slapthebid yagurl_kelly

yagurl_kelly shadowcandlez

shadowcandlez tubekid203

tubekid203 thelastpip

thelastpip deepfrieddelta

deepfrieddelta s1lencetrap

s1lencetrap heyyouboughtthedip

heyyouboughtthedip notanothertrader

notanothertrader vixhunter93

vixhunter93 l33tdreams

l33tdreams chartpotato

chartpotato slapthebid

slapthebid yagurl_kelly

yagurl_kelly shadowcandlez

shadowcandlez tubekid203

tubekid203 thelastpip

thelastpip deepfrieddelta

deepfrieddelta s1lencetrap

s1lencetrap heyyouboughtthedip

heyyouboughtthedip notanothertrader

notanothertrader vixhunter93

vixhunter93 l33tdreams

l33tdreams chartpotato

chartpotato slapthebid

slapthebid yagurl_kelly

yagurl_kelly shadowcandlez

shadowcandlez tubekid203

tubekid203 thelastpip

thelastpip deepfrieddelta

deepfrieddelta s1lencetrap

s1lencetrap heyyouboughtthedip

heyyouboughtthedip notanothertrader

notanothertrader vixhunter93

vixhunter93 l33tdreams

l33tdreams chartpotato

chartpotato slapthebid

slapthebid yagurl_kelly

yagurl_kelly shadowcandlez

shadowcandlez tubekid203

tubekid203 thelastpip

thelastpip deepfrieddelta

deepfrieddelta s1lencetrap

s1lencetrap heyyouboughtthedip

heyyouboughtthedip macd_daddy

macd_daddy jessitrades

jessitrades bagholderino

bagholderino exitbeforegreen

exitbeforegreen ghostrunnerfx

ghostrunnerfx fadedinprofit

fadedinprofit beepboopbuy

beepboopbuy lilstoploss

lilstoploss realtightspreads

realtightspreads up4london

up4london idontchase

idontchase macd_daddy

macd_daddy jessitrades

jessitrades bagholderino

bagholderino exitbeforegreen

exitbeforegreen ghostrunnerfx

ghostrunnerfx fadedinprofit

fadedinprofit beepboopbuy

beepboopbuy lilstoploss

lilstoploss realtightspreads

realtightspreads up4london

up4london idontchase

idontchase macd_daddy

macd_daddy jessitrades

jessitrades bagholderino

bagholderino exitbeforegreen

exitbeforegreen ghostrunnerfx

ghostrunnerfx fadedinprofit

fadedinprofit beepboopbuy

beepboopbuy lilstoploss

lilstoploss realtightspreads

realtightspreads up4london

up4london idontchase

idontchase macd_daddy

macd_daddy jessitrades

jessitrades bagholderino

bagholderino exitbeforegreen

exitbeforegreen ghostrunnerfx

ghostrunnerfx fadedinprofit

fadedinprofit beepboopbuy

beepboopbuy lilstoploss

lilstoploss realtightspreads

realtightspreads up4london

up4london idontchase

idontchaseSimple, Transparent Pricing

Everything you need included into one simple and transparent plan. Unlock AI insights, live news and all the tools with one button.Got Questions About Horizon?

Discover everything you need to know about HorizonThe Horaizon Blog: Your Edge in Market Analysis

Get the latest market insights, AI-powered strategies, and deep dives into key economic events—all designed to help you trade smarter.10 Reasons Top Traders Are Replacing Old-School Calendars with AI Tools

In today’s lightning-fast financial markets, information moves at the speed of light — and traders who can’t keep up get left behind.

Read more10 Economic Events Every Trader Should Track (and How AI Makes It Easier)

If you’ve been trading for any length of time, you know the markets don’t move randomly. Behind every surge, every dip, and every trend, there’s often an economic event that sparks it.

Read more5 Trading Mistakes You’ll Avoid with AI-Driven Market Alerts

In today’s fast-paced markets, speed, precision, and smart decision-making are critical to staying profitable. Yet even the most experienced traders fall into traps: missing key events...

Read more8 Hidden Features of AI Economic Calendars That Smart Traders Use Daily

In today’s hyper-competitive markets, information alone isn’t enough — it’s how you filter, prioritize, and act on that information that separates smart traders from the rest.

Read more7 Ways AI-Powered Economic Calendars Give Traders an Unfair Advantage

In today’s ultra-fast, information-saturated markets, traders face one massive challenge: data overload. Every day, thousands of economic events, news releases, and...

Read moreHow AI Economic Calendars Are Beating Human Analysts to the Punch

In today’s fast-moving financial markets, timing is everything. Whether you're trading currencies, stocks, or commodities, reacting even a few minutes late...

Read moreFrom Data Overload to Smart Alerts: How AI Filters Market Noise Before Key Economic Events

In the high-stakes world of trading, information is both a blessing and a curse. While access to real-time data is crucial, the sheer volume of information...

Read moreTiming Is Everything: Why Traditional Economic Calendars Fail Modern Traders (And What To Use Instead)

In today's fast-paced financial markets, timing isn't just important—it's everything. Economic events such as central bank announcements...

Read moreThe AI Edge: How Machine Learning is Transforming Economic Calendar Alerts for Active Traders

In the fast-paced world of trading, timing is everything. Economic events—like central bank announcements, employment reports, and inflation data

Read moreThe Hidden Advantage: How AI Calendars Predict Volatility Before the News Breaks

In modern financial markets, volatility isn’t random. It often explodes around key events: economic releases, central bank meetings, political headlines.

Read moreHow AI-Powered Economic Calendars Are Revolutionizing Trade Timing in 2025

Manually refreshing outdated economic calendars or reacting late to unexpected data releases leads to missed opportunities—or worse, costly losses.

Read moreSectors on the Brink: Where Tariffs Could Trigger the Next Big Short (and the Hidden Winners)

Trade tensions are back — and they’re bigger than ever. As new rounds of U.S. tariffs rattle global markets, traders and investors must urgently reassess their strategies.

Read more10 Reasons Top Traders Are Replacing Old-School Calendars with AI Tools

In today’s lightning-fast financial markets, information moves at the speed of light — and traders who can’t keep up get left behind.

Read more10 Economic Events Every Trader Should Track (and How AI Makes It Easier)

If you’ve been trading for any length of time, you know the markets don’t move randomly. Behind every surge, every dip, and every trend, there’s often an economic event that sparks it.

Read more5 Trading Mistakes You’ll Avoid with AI-Driven Market Alerts

In today’s fast-paced markets, speed, precision, and smart decision-making are critical to staying profitable. Yet even the most experienced traders fall into traps: missing key events...

Read more8 Hidden Features of AI Economic Calendars That Smart Traders Use Daily

In today’s hyper-competitive markets, information alone isn’t enough — it’s how you filter, prioritize, and act on that information that separates smart traders from the rest.

Read more7 Ways AI-Powered Economic Calendars Give Traders an Unfair Advantage

In today’s ultra-fast, information-saturated markets, traders face one massive challenge: data overload. Every day, thousands of economic events, news releases, and...

Read moreHow AI Economic Calendars Are Beating Human Analysts to the Punch

In today’s fast-moving financial markets, timing is everything. Whether you're trading currencies, stocks, or commodities, reacting even a few minutes late...

Read moreFrom Data Overload to Smart Alerts: How AI Filters Market Noise Before Key Economic Events

In the high-stakes world of trading, information is both a blessing and a curse. While access to real-time data is crucial, the sheer volume of information...

Read moreTiming Is Everything: Why Traditional Economic Calendars Fail Modern Traders (And What To Use Instead)

In today's fast-paced financial markets, timing isn't just important—it's everything. Economic events such as central bank announcements...

Read moreThe AI Edge: How Machine Learning is Transforming Economic Calendar Alerts for Active Traders

In the fast-paced world of trading, timing is everything. Economic events—like central bank announcements, employment reports, and inflation data

Read moreThe Hidden Advantage: How AI Calendars Predict Volatility Before the News Breaks

In modern financial markets, volatility isn’t random. It often explodes around key events: economic releases, central bank meetings, political headlines.

Read moreHow AI-Powered Economic Calendars Are Revolutionizing Trade Timing in 2025

Manually refreshing outdated economic calendars or reacting late to unexpected data releases leads to missed opportunities—or worse, costly losses.

Read moreSectors on the Brink: Where Tariffs Could Trigger the Next Big Short (and the Hidden Winners)

Trade tensions are back — and they’re bigger than ever. As new rounds of U.S. tariffs rattle global markets, traders and investors must urgently reassess their strategies.

Read more10 Reasons Top Traders Are Replacing Old-School Calendars with AI Tools

In today’s lightning-fast financial markets, information moves at the speed of light — and traders who can’t keep up get left behind.

Read more10 Economic Events Every Trader Should Track (and How AI Makes It Easier)

If you’ve been trading for any length of time, you know the markets don’t move randomly. Behind every surge, every dip, and every trend, there’s often an economic event that sparks it.

Read more5 Trading Mistakes You’ll Avoid with AI-Driven Market Alerts

In today’s fast-paced markets, speed, precision, and smart decision-making are critical to staying profitable. Yet even the most experienced traders fall into traps: missing key events...

Read more8 Hidden Features of AI Economic Calendars That Smart Traders Use Daily

In today’s hyper-competitive markets, information alone isn’t enough — it’s how you filter, prioritize, and act on that information that separates smart traders from the rest.

Read more7 Ways AI-Powered Economic Calendars Give Traders an Unfair Advantage

In today’s ultra-fast, information-saturated markets, traders face one massive challenge: data overload. Every day, thousands of economic events, news releases, and...

Read moreHow AI Economic Calendars Are Beating Human Analysts to the Punch

In today’s fast-moving financial markets, timing is everything. Whether you're trading currencies, stocks, or commodities, reacting even a few minutes late...

Read moreFrom Data Overload to Smart Alerts: How AI Filters Market Noise Before Key Economic Events

In the high-stakes world of trading, information is both a blessing and a curse. While access to real-time data is crucial, the sheer volume of information...

Read moreTiming Is Everything: Why Traditional Economic Calendars Fail Modern Traders (And What To Use Instead)

In today's fast-paced financial markets, timing isn't just important—it's everything. Economic events such as central bank announcements...

Read moreThe AI Edge: How Machine Learning is Transforming Economic Calendar Alerts for Active Traders

In the fast-paced world of trading, timing is everything. Economic events—like central bank announcements, employment reports, and inflation data

Read moreThe Hidden Advantage: How AI Calendars Predict Volatility Before the News Breaks

In modern financial markets, volatility isn’t random. It often explodes around key events: economic releases, central bank meetings, political headlines.

Read moreHow AI-Powered Economic Calendars Are Revolutionizing Trade Timing in 2025

Manually refreshing outdated economic calendars or reacting late to unexpected data releases leads to missed opportunities—or worse, costly losses.

Read moreSectors on the Brink: Where Tariffs Could Trigger the Next Big Short (and the Hidden Winners)

Trade tensions are back — and they’re bigger than ever. As new rounds of U.S. tariffs rattle global markets, traders and investors must urgently reassess their strategies.

Read more10 Reasons Top Traders Are Replacing Old-School Calendars with AI Tools

In today’s lightning-fast financial markets, information moves at the speed of light — and traders who can’t keep up get left behind.

Read more10 Economic Events Every Trader Should Track (and How AI Makes It Easier)

If you’ve been trading for any length of time, you know the markets don’t move randomly. Behind every surge, every dip, and every trend, there’s often an economic event that sparks it.

Read more5 Trading Mistakes You’ll Avoid with AI-Driven Market Alerts

In today’s fast-paced markets, speed, precision, and smart decision-making are critical to staying profitable. Yet even the most experienced traders fall into traps: missing key events...

Read more8 Hidden Features of AI Economic Calendars That Smart Traders Use Daily

In today’s hyper-competitive markets, information alone isn’t enough — it’s how you filter, prioritize, and act on that information that separates smart traders from the rest.

Read more7 Ways AI-Powered Economic Calendars Give Traders an Unfair Advantage

In today’s ultra-fast, information-saturated markets, traders face one massive challenge: data overload. Every day, thousands of economic events, news releases, and...

Read moreHow AI Economic Calendars Are Beating Human Analysts to the Punch

In today’s fast-moving financial markets, timing is everything. Whether you're trading currencies, stocks, or commodities, reacting even a few minutes late...

Read moreFrom Data Overload to Smart Alerts: How AI Filters Market Noise Before Key Economic Events

In the high-stakes world of trading, information is both a blessing and a curse. While access to real-time data is crucial, the sheer volume of information...

Read moreTiming Is Everything: Why Traditional Economic Calendars Fail Modern Traders (And What To Use Instead)

In today's fast-paced financial markets, timing isn't just important—it's everything. Economic events such as central bank announcements...

Read moreThe AI Edge: How Machine Learning is Transforming Economic Calendar Alerts for Active Traders

In the fast-paced world of trading, timing is everything. Economic events—like central bank announcements, employment reports, and inflation data

Read moreThe Hidden Advantage: How AI Calendars Predict Volatility Before the News Breaks

In modern financial markets, volatility isn’t random. It often explodes around key events: economic releases, central bank meetings, political headlines.

Read moreHow AI-Powered Economic Calendars Are Revolutionizing Trade Timing in 2025

Manually refreshing outdated economic calendars or reacting late to unexpected data releases leads to missed opportunities—or worse, costly losses.

Read moreSectors on the Brink: Where Tariffs Could Trigger the Next Big Short (and the Hidden Winners)

Trade tensions are back — and they’re bigger than ever. As new rounds of U.S. tariffs rattle global markets, traders and investors must urgently reassess their strategies.

Read more